Conducting technical analysis for stock trading as a side hustle involves analyzing market trends and chart patterns to make informed investment decisions. To start, you'll need a proper trading station, which typically consists of a computer, monitor, and trading software or platform.

To implement this side hustle, follow these steps:

- Develop a solid understanding of chart patterns and market trends. This can be achieved by studying technical analysis books, online courses, and resources.

- Choose a trading software or platform, such as Thinkorswim or TradingView, and learn how to navigate its features.

- Set up your trading station with a computer, monitor, and internet connection.

- Create a watchlist of stocks you're interested in trading and analyze their chart patterns and trends.

- Use indicators, such as moving averages and RSI, to identify buy and sell signals.

- Develop a trading plan and set entry and exit points for each trade.

- Practice trading with a demo or paper account to hone your skills before investing real money.

- Continuously monitor and analyze market trends and chart patterns to stay informed and adapt to market changes.

Key concepts to focus on when conducting technical analysis for stock trading include:

- Identifying trend lines, support, and resistance levels

- Analyzing chart patterns, such as reversals and continuation patterns

- Using indicators to confirm trading signals

- Understanding market psychology and sentiment

Key Takeaways

- Understand technical analysis basics, including chart patterns and market psychology, to make informed stock trading decisions as a side hustle.

- Set up a trading station with essential tools, such as charting software and real-time data feed, to analyze and execute trades effectively.

- Identify trends and patterns in stock prices, using techniques like moving averages and momentum indicators, to inform trading decisions.

- Manage risk and emotions by setting realistic goals, diversifying income streams, and continuously monitoring and adjusting risk management strategies.

Understanding Technical Analysis Basics

When you start using technical analysis for your side hustle in stock trading, you'll frequently rely on historical price data and patterns to identify trends and predict future price movements. This approach is based on the idea that market prices reflect all publicly available information, and by analyzing charts and patterns, you can gain insight into market psychology.

Chart reading is an essential skill in technical analysis, as it allows you to visualize price movements and identify patterns that may indicate future price direction, helping you make informed decisions to maximize your side hustle profits.

As you explore deeper into technical analysis, you'll learn to recognize various chart patterns, such as trends, reversals, and continuation patterns. These patterns can help you understand market sentiment and make informed trading decisions, which is crucial for a successful side hustle in stock trading.

Market psychology also plays a significant role in technical analysis, as it helps you understand the emotional and behavioral aspects of market participants. By combining chart reading and market psychology, you can develop a more thorough understanding of market dynamics and improve your side hustle performance.

Setting Up Your Trading Station

As a side hustler looking to dive into technical analysis, setting up a well-organized trading station is essential. This will serve as the nerve center for analyzing and executing trades, helping you stay focused and make better decisions.

| Trading Tool | Description | Cost |

|---|---|---|

| Charting Software | Plots price movements and technical indicators | $50/month |

| Real-time Data Feed | Provides current market prices and news | $20/month |

| Trading Simulator | Allows you to practice trading with fake money | $30/month |

| Workspace Organization | Customizes your workspace layout and design | $100 (one-time) |

To maximize productivity in your trading station, prioritize a comfortable and ergonomic workspace organization, including a suitable chair, desk, and monitor setup. This will aid in maintaining focus during extended trading sessions. Investing in the right trading tools and workspace organization will enhance your ability to analyze markets, identify opportunities, and make informed trading decisions.

Identifying Trends and Patterns

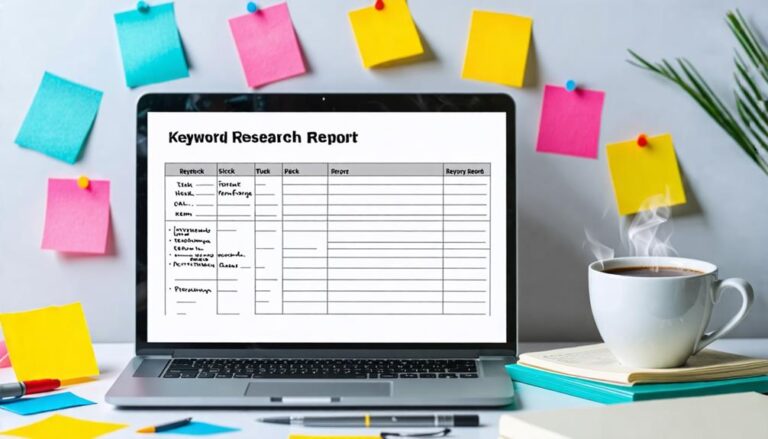

Analyzing side hustle metrics and identifying trends and patterns is crucial to optimizing your part-time business, as it enables you to recognize potential growth opportunities and make informed decisions based on data-driven insights.

You'll focus on recognizing uptrends in client acquisition, downtrends in sales, and sideways trends in website traffic, as well as identifying potential areas for improvement.

To do this, you'll examine metrics for patterns, such as peak hours of engagement, customer demographics, and sales funnel conversions, like identifying successful marketing channels or bottlenecks in the customer journey.

Using Indicators and Oscillators

Analyzing side hustle profits and expenses using indicators and oscillators can help refine your understanding of business dynamics and make more informed financial decisions.

Applying moving averages to gauge the direction and strength of revenue trends can be beneficial. Short-term moving averages can help identify minor fluctuations in earnings, while long-term moving averages can provide a broader view of the business's overall financial trend.

Employing momentum indicators can also assess the speed and magnitude of changes in side hustle profits. Indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can help detect potential financial setbacks and confirm periods of steady growth.

By combining moving averages and momentum indicators, you can gain a more thorough understanding of your side hustle's financial forces. You can identify areas where expenses can be reduced, anticipate potential opportunities for growth, and adjust your business strategy accordingly.

Managing Risk and Emotions

As a side hustler, managing risk and emotions is crucial to maintaining a healthy and profitable venture. Balancing rational decision-making with the inevitable emotional responses that arise from uncertainty can be a significant challenge. To navigate this, it's essential to understand your risk tolerance and develop emotional discipline.

Risk tolerance refers to your ability to withstand setbacks, while emotional discipline involves making decisions based on data and analysis rather than emotions.

You can manage risk by setting realistic goals, diversifying your income streams, and developing a contingency plan. These strategies help limit potential losses and reduce emotional stress.

Additionally, creating a business plan and sticking to it can help you stay focused on your objectives and avoid impulsive decisions. It's also essential to continuously monitor and adjust your risk management strategies as your side hustle evolves.

Conclusion

Conducting technical analysis for stock trading as a side hustle requires ongoing learning and discipline.

A study by the Chartered Financial Analyst (CFA) Institute found that technical analysis can be effective in predicting price movements, with a success rate of up to 60%.

By continuously refining your strategy and applying technical analysis principles, you can make informed decisions and potentially increase your side hustle earnings.

0

View comments